per capita tax meaning

The meaning of PER CAPITA is per unit of population. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

The Per Capita Tax Survey 2020

Determine the number that correlates with.

. Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate. I am new to the area can I get added the tax rolls. I am a Phoenixville resident.

Usually per capita calculations are done for cities states or. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per capita Unit Number of people in a population.

For most areas adult is defined as 18 years of age and older though in some. Consider talking to a financial advisor. A term used in the Descent and Distribution of the estate of one who dies without a will.

2 weeks ago Nov 29 2021 Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a. For most areas adult is defined as 18 years. What is Per Capita Tax and What Does It Mean to You.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. It can apply to the average per-person income for a city region or country and is.

Latin By the heads or polls. Per capita is simply another way of saying per person The phrase is most commonly used to give context to data. It means to share and share alike according to the.

What is Per Capita Tax and What Does It Mean to You. What is the Per Capita tax. Take the following steps to calculate the per capita of a particular situation.

By or for each person. How do I file a request for exemption from the per capitaoccupation tax. How to use per capita in a sentence.

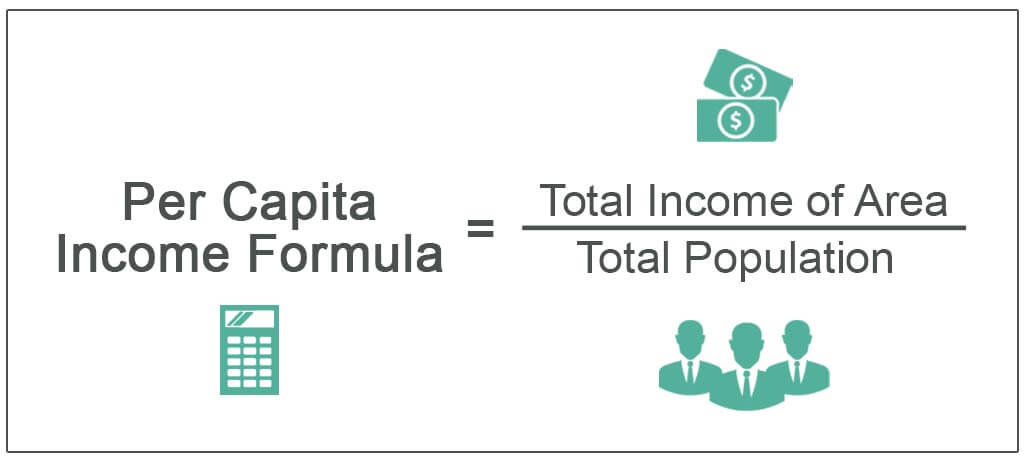

Per capita GDP is a measure of the total output of a country that takes gross domestic product GDP and divides it by the number of people in the country. When comparing information between two groups it. Income per capita is a measure of the amount of money earned per person in a certain area.

It means to share and share alike according to the number of. The definition of income per capita is simply the average amount of money earned by people living in a specific area. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing.

The main purpose of per capita income to present the average income of a nation is a great tool to manage wealth among nations. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. 1 day ago Nov 29 2021 The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

It is calculated by dividing the areas. Using the ratio explicitly an increase.

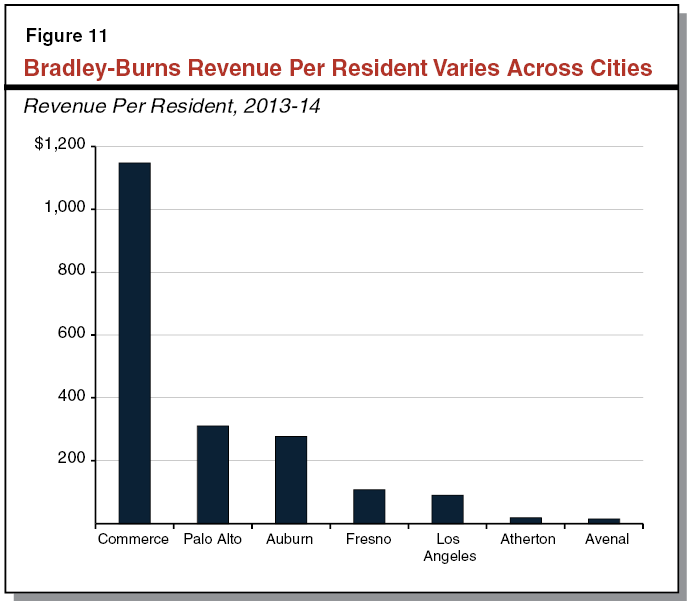

Understanding California S Sales Tax

Germany Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

State Corporate Income Tax Collections Per Capita 2019

Understanding Per Capita Water Use City Of Santa Cruz

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

What Is Income Per Capita Uses Limitations And Examples

What Is Per Capita Tax And What Does It Mean To You The Handy Tax Guy

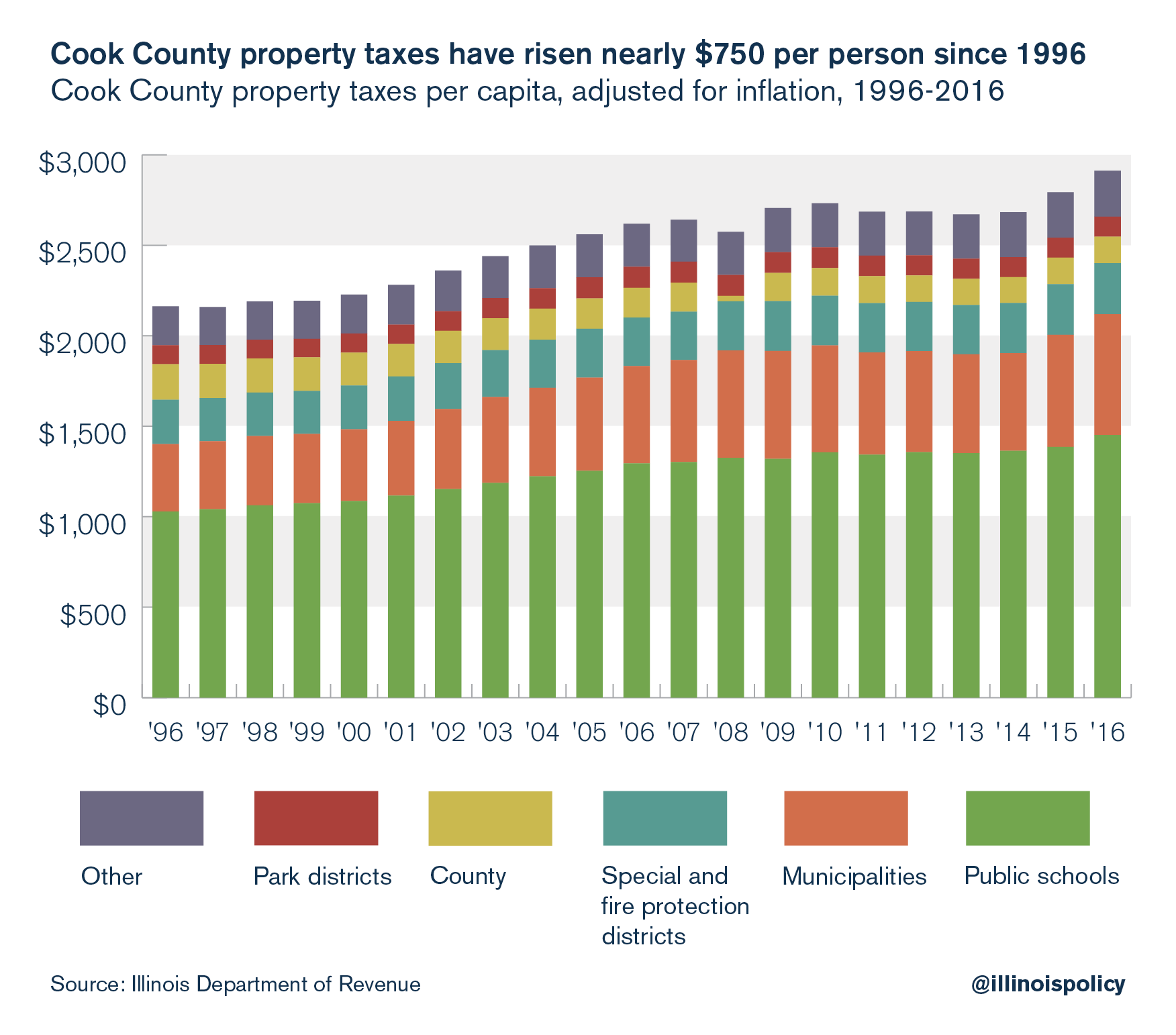

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

What Is Per Capita Tax And What Does It Mean To You The Handy Tax Guy

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_PercapitaGDP_finalv1-1b4deeedcfad411fbaf12a6f93bc0ac3.png)

Per Capita Gdp Defined Applications And Highest Per Country

What Is Per Capita Tax And What Does It Mean To You The Handy Tax Guy

Per Capita Income Formula Examples How To Calculate

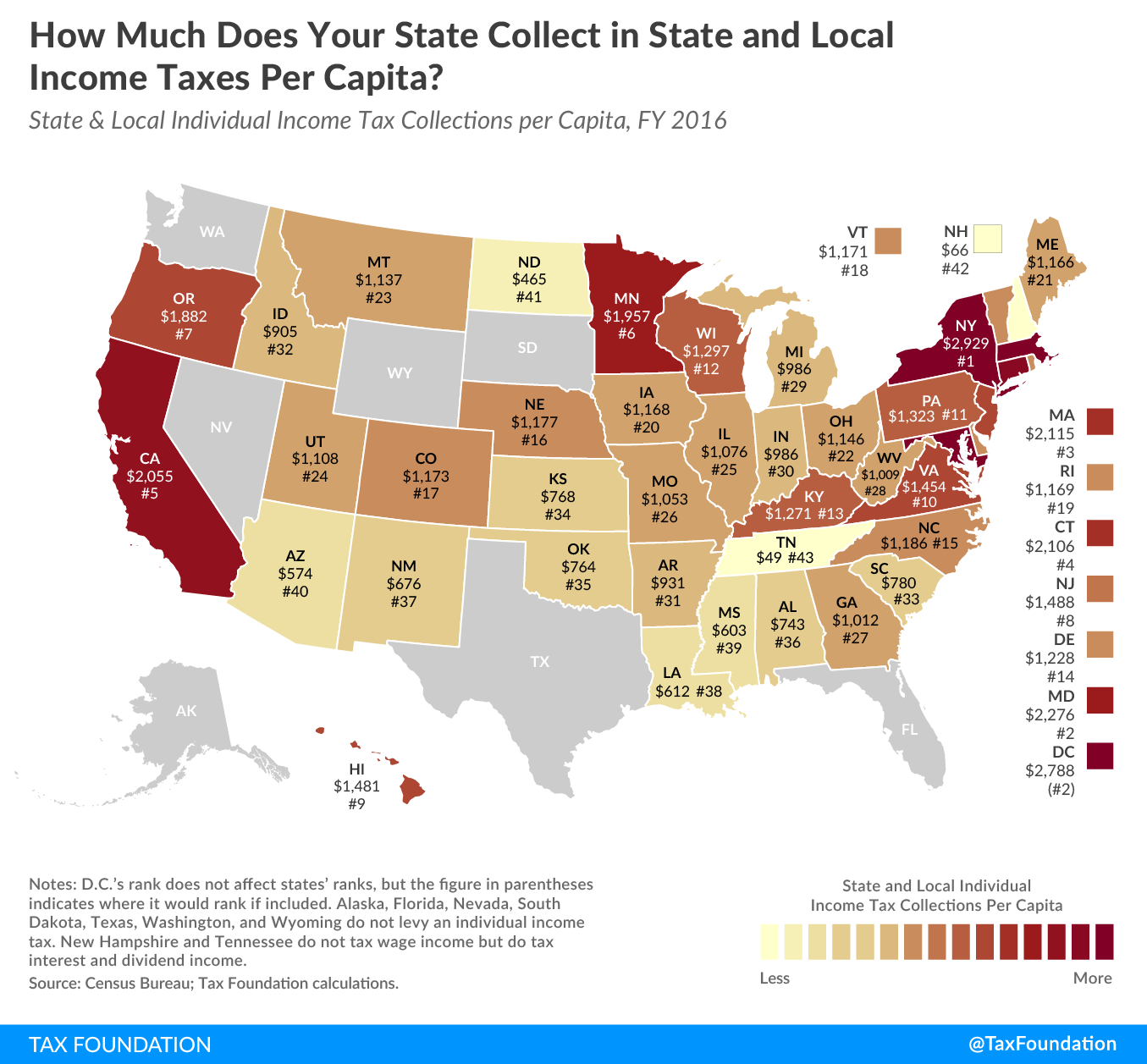

Income Taxes Per Capita How Does Your State Compare 2019 Update

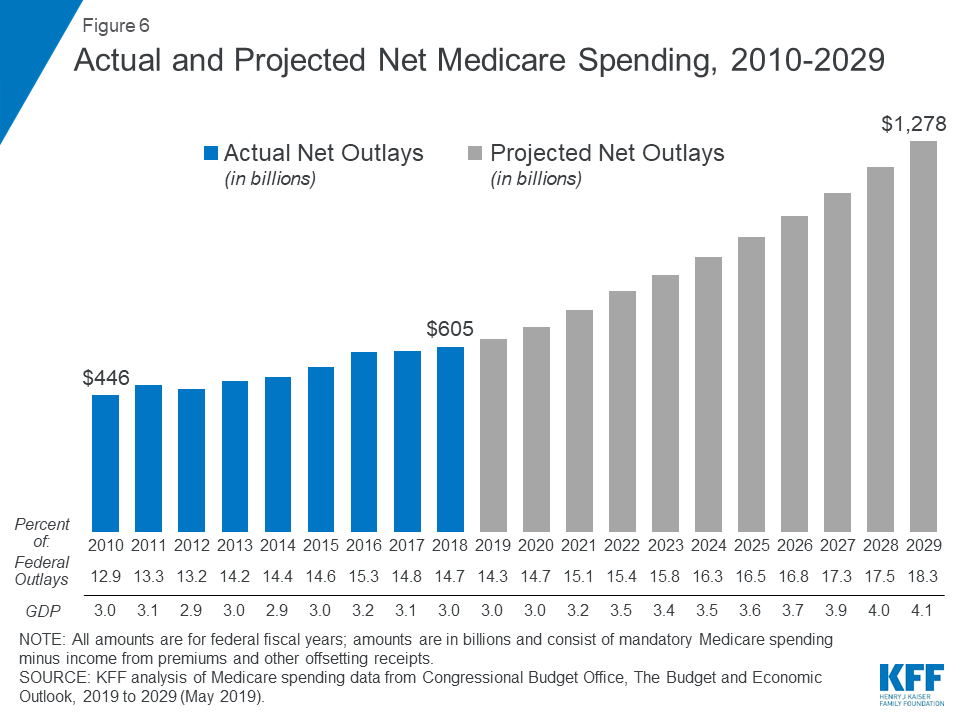

The Facts On Medicare Spending And Financing Kff

P C O T R What Does Pcotr Mean In Business Per Capita

State Corporate Income Tax Collections Per Capita Tax Foundation

Per Capita Tax Burden Is Misleading Public Assets Institute

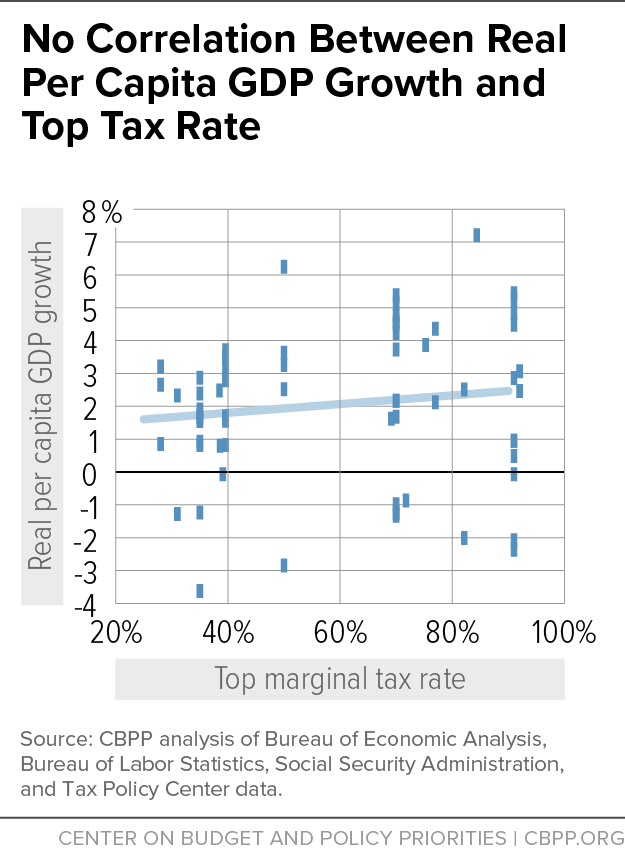

Meeting The Goals Of The Federal Tax System Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc():gifv()/per-capita-what-it-means-calculation-how-to-use-it-3305876-v2-b6cae48d99e741d299a8065af0fc29ad.png)